How to Compute Debt to Equity Ratio

Finally, if we assume that the company will not default over the next year, then debt due sooner shouldn’t be a concern. In contrast, a company’s ability to service long-term debt will depend on its long-term business prospects, which are less certain. If both companies have $1.5 million in shareholder equity, then they both have a D/E ratio of 1. On the surface, the risk from leverage is identical, but in reality, the second company is riskier. Business owners use a variety of software to track D/E ratios and other financial metrics. Microsoft Excel provides a balance sheet template that automatically calculates financial ratios such as the D/E ratio and the debt ratio.

How to calculate stockholders’ equity?

For example, a company may not borrow any funds to support business operations, not because it doesn’t need to but because it doesn’t have enough capital to repay it promptly. Many companies borrow money to maintain business operations — making it a typical practice for many businesses. For companies with steady and consistent cash flow, repaying debt happens rapidly. Also, because they repay debt quickly, these businesses will likely have solid credit, which allows them to borrow inexpensively from lenders. But let’s say Company A has $2 million in long-term liabilities, and $500,000 in short-term liabilities, whereas Company B has $1.5 million in long-term debt and $1 million in short term debt. The long-term D/E ratio for Company A would be 0.8 vs. 0.6 for company B, indicating a higher risk level.

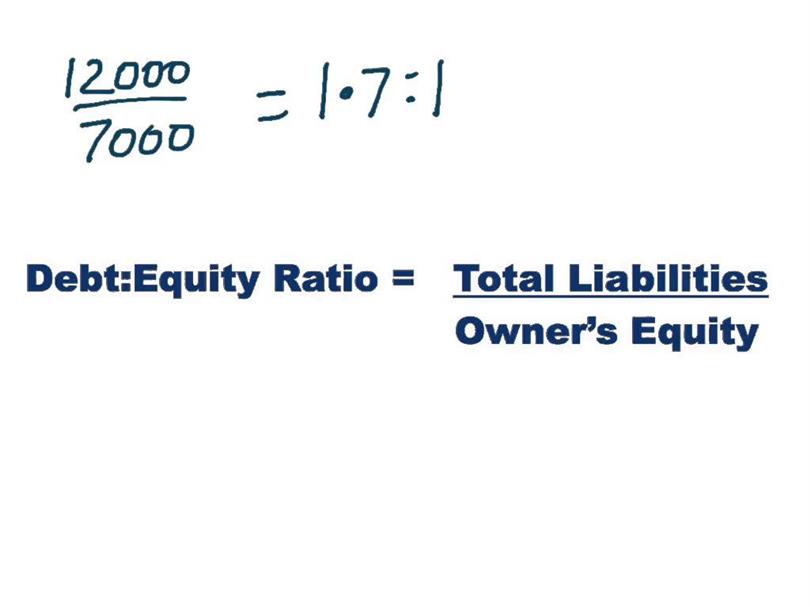

Debt to Equity Ratio Formula & Example

A debt to equity ratio of 1 would mean that investors and creditors have an equal stake in the business assets. A high debt-equity ratio can be good because it shows that a firm can easily service its debt obligations (through cash flow) and is using the leverage to increase equity returns. Business debt, or liability, is anything that you owe or anything that’s unpaid. This means any financial liabilities you’ve taken on, like a small business loan, mortgage or line of credit. Anything you have to pay back – even that unofficial loan from a mate – is classified as being part of your business’s debt obligations.

- Whether evaluating investment options or weighing business risks, the debt to equity ratio is an essential piece of the puzzle.

- Also, this ratio looks specifically at how much of a company’s assets are financed with debt.

- You can find the inputs you need for this calculation on the company’s balance sheet.

- Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

- Companies with a high D/E ratio can generate more earnings and grow faster than they would without this additional source of funds.

Debt-to-Equity (D/E) Ratio

If earnings outstrip the cost of the debt, which includes interest payments, a company’s shareholders can benefit and stock prices may go up. The interest rates on business loans can be relatively low, and are tax deductible. That makes debt an attractive way to fund business, especially compared to the potential returns from the stock market, which can be volatile. The company can use the funds they borrow to buy equipment, inventory, or other assets — or to fund new projects or acquisitions. The money can also serve as working capital in cyclical businesses during the periods when cash flow is low. If a company’s debt to equity ratio is 1.5, this means that for every $1 of equity, the company has $1.50 of debt.

Companies with a high D/E ratio can generate more earnings and grow faster than they would without this additional source of funds. However, if the cost of debt interest on financing turns out to be higher than the returns, the situation can become unstable and lead, in extreme cases, to bankruptcy. In the financial industry (particularly banking), a similar concept is equity to total assets (or equity to risk-weighted assets), otherwise known as capital adequacy. If a company cannot pay the interest and principal on its debts, whether as loans to a bank or in the form of bonds, it can lead to a credit event. The D/E ratio is one way to look for red flags that a company is in trouble in this respect. If a company has a D/E ratio of 5, but the industry average is 7, this may not be an indicator of poor corporate management or economic risk.

There are several metrics that are used to gauge the financial health of a company, how the company finances its business operations and assets, as well as its level of exposure to risk. The Debt to Equity ratio is a financial metric that compares a company’s total debt to its shareholder equity. In a basic sense, Total Debt / Equity is a measure of all of a company’s future obligations on the balance sheet relative to equity. However, the ratio can be more discerning as to what is actually a borrowing, as opposed to other types of obligations that might exist on the balance sheet under the liabilities section. For example, often only the liabilities accounts that are actually labelled as “debt” on the balance sheet are used in the numerator, instead of the broader category of “total liabilities”.

Both IFRS and GAAP require that retained earnings be included in the denominator of the debt-to-equity ratio. If equity is negative, it means that a company’s liabilities exceed its assets, which is often referred to as “negative net worth” or “insolvency”. In this what is heinrich theory situation, the debt-to-equity ratio would not be meaningful because the denominator (equity) is negative. A negative debt-to-equity ratio would also not be meaningful because it would indicate that the company has more debt than equity, which is not possible.

Companies should aim for a balanced ratio to mitigate these risks while leveraging debt for growth. The interest paid on debt also is typically tax-deductible for the company, while equity capital is not. Yes, the ratio doesn’t consider the quality of debt or equity, such as interest rates or equity dilution terms. Here, “Total Debt” includes both short-term and long-term liabilities, while “Total Shareholders’ Equity” refers to the ownership interest in the company.

For example, companies in the utility industry must borrow large sums of cash to purchase costly assets to maintain business operations. However, since they have high cash flows, paying off debt happens quickly and does not pose a huge risk to the company. A company’s total liabilities are the aggregate of all its financial obligations to creditors over a specific period of time, and typically include short term and long term liabilities and other liabilities. The debt to equity ratio is a financial, liquidity ratio that compares a company’s total debt to total equity. The debt to equity ratio shows the percentage of company financing that comes from creditors and investors. A higher debt to equity ratio indicates that more creditor financing (bank loans) is used than investor financing (shareholders).

Martin loves entrepreneurship and has helped dozens of entrepreneurs by validating the business idea, finding scalable customer acquisition channels, and building a data-driven organization. During his time working in investment banking, tech startups, and industry-leading companies he gained extensive knowledge in using different software tools to optimize business processes. If the company uses its own money to purchase the asset, which they then sell a year later after 30% appreciation, the company will have made $30,000 in profit (130% x $100,000 – $100,000). This is because the company will still need to meet its debt payment obligations, which are higher than the amount of equity invested into the company.