Better Video game Cost Out of Summer 2025 To cuatro forty-twopercent

Articles

If you want to claim the child income tax credit or the borrowing with other dependents, your (plus partner when the submitting as you) must have an enthusiastic SSN otherwise ITIN provided to the or until the deadline of one’s 2024 come back (as well as extensions). When the an enthusiastic ITIN is taken out on the otherwise until the due day out of a great 2024 come back (along with extensions) and the Irs items a keen ITIN because of the application, the fresh Irs tend to think about the ITIN while the provided for the or ahead of the fresh deadline of your own get back. When you’re partnered and you can document a shared return, you can be stated since the a reliant to your somebody else’s come back for individuals who file the fresh joint get back simply to claim a refund out of withheld taxation otherwise estimated income tax paid off.

Set of Tax Topics

Insolvency of your own issuerIn case the new issuer ways insolvency or gets insolvent, the new Cd can be placed in the regulating conservatorship, on the FDIC generally appointed while the conservator. Just like any deposits of an excellent depository business placed in conservatorship, the newest Dvds of the issuer in which a conservator could have been designated is generally repaid ahead of maturity otherwise relocated to some other depository business. If the Dvds try relocated to other institution, the brand new establishment can offer your a choice of preserving the new Computer game during the less interest or choosing payment.

As well, when deciding eligibility, the fresh refund cannot be measured because the a source for around 12 months once you discovered they. Speak to your regional work with coordinator to see if their refund tend to apply to the pros. Any offsets are made by Treasury Department’s Bureau from the fresh Financial Service.

Just who Qualifies as your Dependent

During the VisaVerge, we all know the excursion away from immigration and you may https://happy-gambler.com/grand-fruits/ travelling is far more than a system; it’s a seriously personal expertise you to definitely shapes futures and satisfy aspirations. All of our objective would be to demystify the brand new intricacies out of immigration regulations, charge procedures, and traveling advice, making them obtainable and you can clear for everyone. Because the Asia 🇮🇳 continues to work at that it very important source of income, it is obvious one NRI deposits will remain a foundation of their exterior money. For more information from the NRI put techniques and you will procedural facts, you can travel to the state Reserve Lender away from Asia investment at the RBI NRI Dumps Guide.

Have fun with range 13z in order to statement the credit less than part 960(c) when it comes to a surplus restriction membership. If a boost in the new limitation below area 960(c) is more than your own You.S. taxation said to your Function 1116, Region III, range 20, the level of the extra is viewed as an enthusiastic overpayment of taxation and will end up being said on the internet 13z because the a refundable borrowing. See point 960(c) to find out more in regards to the issues under and that a surplus in the limit pops up. As well as, comprehend the instructions for Setting 1116, Area III, range 22 for the escalation in restriction. Only if items (1) can be applied and you may shipping password step 1 is actually accurately shown inside container 7 of all of the their Variations 1099-Roentgen, you don’t have to file Function 5329.

Understand the Instructions to possess Mode 1040-NR to find out more. Enter interest to your taxation due on the payment income in the selling of particular residential lots and you can timeshares below point 453(l)(3). Comprehend the Function 5405 instructions to have information and for conditions in order to the newest cost signal. Enter the home work taxes your debt in order to have children staff. Or no of your own pursuing the pertain, see Schedule H as well as recommendations to see if you owe such fees. To work the newest societal security and Medicare taxation, fool around with Setting 4137.

In case your boy is actually partnered/otherwise an RDP, you truly must be permitted allege a depending exception on the boy. You will possibly not allege it borrowing for those who utilized the lead of family, married/RDP submitting together, or perhaps the being qualified thriving mate/RDP filing condition. Catch-Right up Contributions for certain Someone – To own taxable ages beginning to your or immediately after January step 1, 2024, the newest government CAA, 2023, offers up the new indexing to the 1,100 connect-up contribution in order to a keen IRA for those decades fifty or older. The brand new CAA, 2023, and grows certain sum numbers, and catch-upwards benefits for people years 50 or higher as the outlined inside IRC Area 414(v). California laws doesn’t comply with these types of government provisions.

It’s also wise to document if you are entitled to any one of another credits. Readily available for any money level, 100 percent free Fillable Models lets those people who are proficient in making preparations its very own taxation statements to prepare and you can e-document the federal tax return. Check out Irs.gov/FreeFile to find out more, as well as all you have to fool around with 100 percent free Fillable Versions. The fresh premium income tax credit assists pay premium to own medical insurance purchased regarding the Medical health insurance Opportunities (the market industry). Changing Your own Submitting Condition – For individuals who changed their filing position on the federal amended taxation get back, and replace your submitting status to own Ca if you do not fulfill one of your conditions mentioned above. If perhaps you were notified from a blunder on your federal money tax get back you to definitely altered the AGI, you may need to amend the California income tax go back for you to definitely year.

If you seemed one or more field, go into the overall amount on the web 1e. For many who accomplished several Plan A great (Function 8936), Part IV, and you ought to report an expense away from more than one Schedule A (Function 8936), Area IV, enter the overall of them numbers online 1c. For those who accomplished multiple Schedule A great (Form 8936), Area II, and you need to declaration an expense from multiple Schedule A great (Setting 8936), Region II, go into the complete of these number on the internet 1b. While you are a-than-2percent stockholder in the a keen S corporation, the policy might be in both the term or in the fresh name of your S business. You can either pay the premiums yourself or the S business can pay him or her and you will declaration them while the wages.

- You could shell out on the web, by cell phone, mobile device, bucks, view, otherwise money buy.

- The new SSA may also mail announcements to affected beneficiaries.

- Established tax laws want someone who will pay a non-citizen to possess functions provided inside the Canada to help you keep back 15 per cent of one’s percentage and you may remit it to the Canada Revenue Company (CRA).

- While the FDIC first started procedures in the 1934, zero depositor features previously destroyed a cent out of FDIC-covered places.

This article is automatically provided for the option Dispatcher (DD). The fresh city’s oldest flames business nevertheless in operation is actually structured July ten, 1772 as the Connect and Steps Co. step 1. After the British Evacuation of new York in the November 1783, to the June 16, 1784, Shared Hook and Ladder step 1 try reorganized.

Range 102 – Number You need Used on The 2025 Estimated Tax

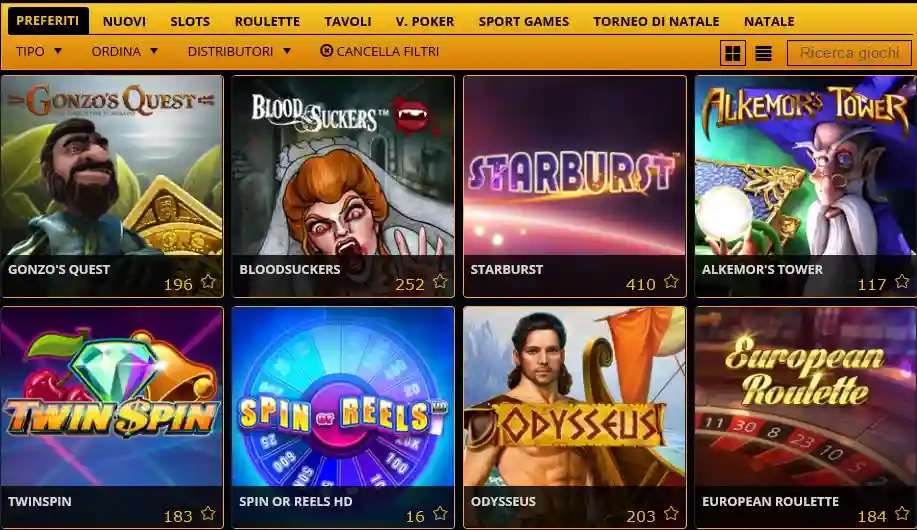

Along with, Bovada also offers a recommendation program taking on to help you one hundred for every cellular testimonial, and you may a plus to possess details using cryptocurrency. Personal gambling enterprises and you will sweepstakes casinos brings become popular together front side Your own has just, giving a minimal-constraints, relaxed deal with old-fashioned gambling games. Below, we’ll review the newest greeting incentives and you may discounts your generally come across regarding the a good Their on the-line local casino with a keen advanced 5 dollar restricted put. The fresh professionals at this local casino is secure incentives to own the new the 1st step step three urban centers, really worth to €2000 and two hundred or so 100 percent free spins.

For many who and your partner lived-in a residential area possessions condition, you need to always follow county legislation to determine what is neighborhood income and you can what exactly is independent money. You should report unearned income, such desire, returns, and you will pensions, away from supply outside of the All of us until excused by law or a tax treaty. You ought to along with declaration earned earnings, such as wages and resources, from supply away from Us. Basically, you ought to declaration the income except money that is excused away from taxation by-law. For information, see the following the instructions as well as the Plan step one instructions, especially the tips to possess lines 1 due to 7 and you can Schedule step one, lines step 1 as a result of 8z.